IRS 1098-E 2024-2025 free printable template

Show details

Attention:

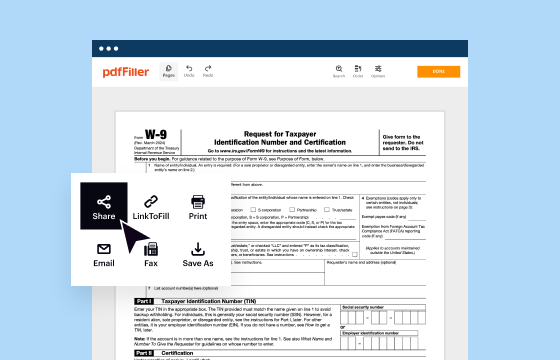

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable,

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1098-E

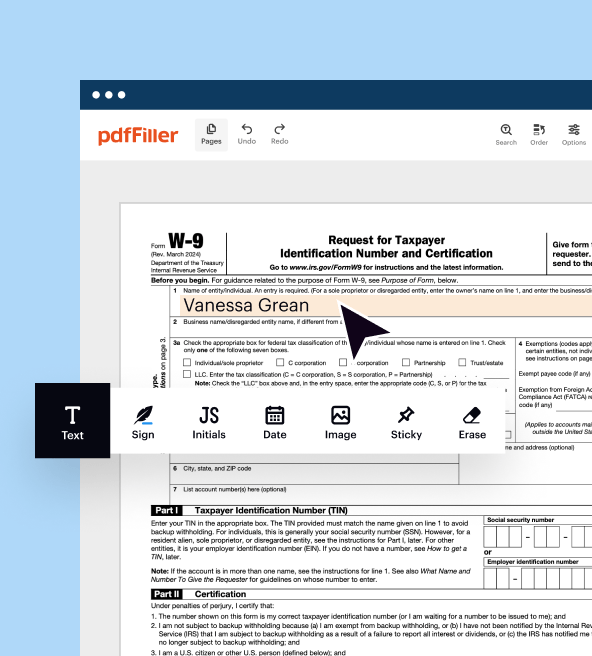

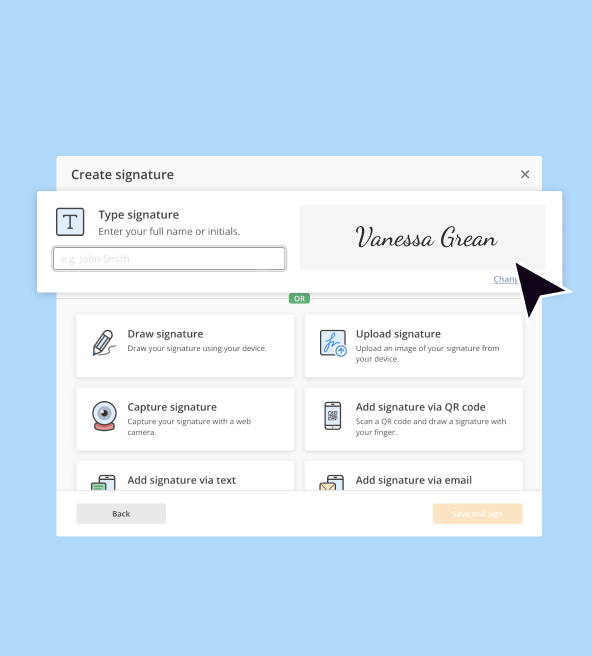

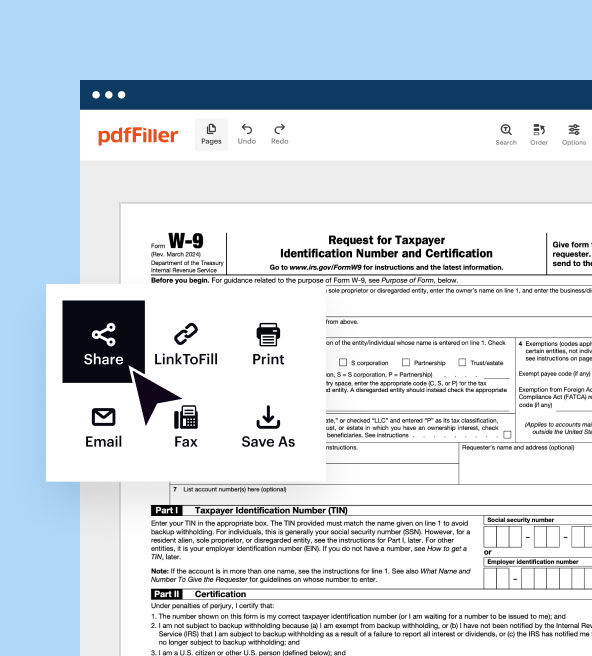

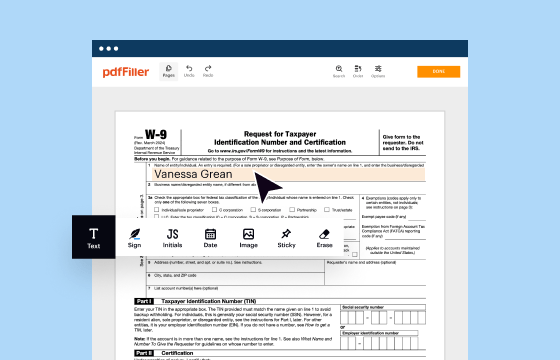

A Comprehensive Guide to Editing IRS 1098-E

Instructions for Completing IRS 1098-E

Understanding and Utilizing IRS 1098-E

The IRS 1098-E form plays a crucial role in student loan interest reporting, enabling borrowers to claim tax deductions. Accurate comprehension of this form is essential for maximizing deductions and ensuring compliance with tax regulations. In this guide, we break down everything you need to know about the IRS 1098-E, from its purpose to detailed filing instructions.

A Comprehensive Guide to Editing IRS 1098-E

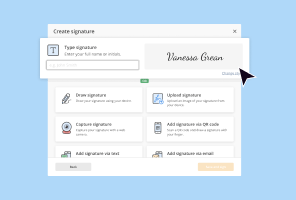

To effectively edit your IRS 1098-E form, follow these detailed steps:

01

Gather your financial statements related to student loans for the tax year.

02

Locate the corresponding 1098-E form from your loan servicer; it can usually be found online or in your account statements.

03

Verify the accuracy of the borrower’s information, including the name, address, and social security number.

04

Check the interest amount reported in Box 1 to ensure it reflects only the interest you paid during the year.

05

Confirm that the loan servicer’s information is correctly listed in the form.

06

If discrepancies are found, contact your loan servicer to request corrections.

Instructions for Completing IRS 1098-E

Completing the IRS 1098-E form accurately is key to successful tax deduction claims. Here's how:

01

Enter your personal identifying information in section one, ensuring it's consistent with your tax return.

02

In Box 1, record the total interest paid on student loans during the tax year. Verify this amount with your loan statements.

03

If applicable, include the tax identification number (TIN) for any qualifying loan servicer in Box 2.

04

Review the form thoroughly for errors before submission. Correct information is essential to avoid penalties.

Show more

Show less

Recent Changes and Updates Regarding IRS 1098-E

Recent Changes and Updates Regarding IRS 1098-E

Staying updated on changes to IRS 1098-E is key for accurate filing. Recently, the IRS has implemented the following updates:

01

As of the tax year 2022, new reporting guidelines require loan servicers to specify the breakdown of interest paid on consolidated loans.

02

Thresholds for reporting have changed; loan servicers now must issue 1098-E forms only for interest amounts exceeding $600.

03

Clearer instructions on what constitutes qualified interest have been established, particularly concerning deferments and forbearances.

Essential Insights into IRS 1098-E's Purpose and Functions

What is IRS 1098-E?

What is the Purpose of IRS 1098-E?

Who Should File IRS 1098-E?

When Does Exemption from Filing Apply?

Components of the IRS 1098-E Form

Filing Deadline for IRS 1098-E

Comparing IRS 1098-E with Related Tax Forms

Transactions Covered by IRS 1098-E

Required Copies for Submission

Penalties for Not Submitting IRS 1098-E

Information Needed for Filing IRS 1098-E

Other Forms Accompanying IRS 1098-E

Submission Address for IRS 1098-E

Essential Insights into IRS 1098-E's Purpose and Functions

What is IRS 1098-E?

IRS 1098-E is a form used to report student loan interest payments made by borrowers. This information is critical for tax purposes, allowing eligible individuals to deduct their student loan interest from taxable income.

What is the Purpose of IRS 1098-E?

The primary purpose of the IRS 1098-E is to inform both the taxpayer and the IRS regarding how much interest was paid on qualified student loans during a calendar year. This reporting enables taxpayers to claim the student loan interest deduction, which can significantly reduce tax liability.

Who Should File IRS 1098-E?

Any taxpayer who has paid interest on qualified student loans should receive a 1098-E form from their loan servicer. It is essential for those looking to take advantage of the available tax deductions associated with student loan interest payments.

When Does Exemption from Filing Apply?

Exemptions from filing IRS 1098-E applies under the following conditions:

01

If the borrower’s total interest paid is below $600; no form is required.

02

When the loan has been fully paid off prior to the beginning of the tax year.

03

Interest is not considered qualified if it is for a loan taken out for a non-educational purpose.

Components of the IRS 1098-E Form

The IRS 1098-E form consists of several key components:

01

Box 1: Total interest paid.

02

Box 2: Loan servicer’s contact information and TIN.

03

Box 3: Indication of whether the borrower received any interest deduction benefits.

04

Box 4: Notes for the borrower regarding reporting interest deductions.

Filing Deadline for IRS 1098-E

The filing deadline for IRS 1098-E is typically January 31 of the following year. Ensure that your form is filed promptly to avoid issues with your tax return.

Comparing IRS 1098-E with Related Tax Forms

Unlike forms like IRS 1098-T, which reports qualified tuition and related expenses, IRS 1098-E focuses solely on interest paid on student loans. Understanding these differences helps taxpayers accurately navigate their educational financial responsibilities.

Transactions Covered by IRS 1098-E

The IRS 1098-E covers all interest payments made on qualified student loans, including:

01

Interest on federal student loans (e.g., Direct Loans).

02

Interest on private educational loans if the loans were taken out for qualified expenses.

03

Refinanced loans that still qualify for deductibility.

Required Copies for Submission

Typically, the borrower should retain one copy for their records, while the loan servicer submits their designated copy to the IRS. There are no specific additional copies required unless requested during an audit.

Penalties for Not Submitting IRS 1098-E

Failure to comply with IRS 1098-E submission can incur several penalties:

01

Failure to file timely can result in fines up to $270 per form.

02

Fraudulent information may lead to harsher penalties, including fines and legal action.

03

Inaccurate reporting can disqualify taxpayers from claiming the interest deduction, resulting in higher tax liabilities.

Information Needed for Filing IRS 1098-E

Key information required for filing IRS 1098-E includes:

01

Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

02

The total amount of interest paid during the tax year as documented by your loan servicer.

03

The loan servicer’s TIN for correct reporting purposes.

Other Forms Accompanying IRS 1098-E

In most cases, IRS 1098-E is filed alone. However, if students are filing for educational credits, they may also need to complete IRS 8863 for education credits, providing necessary details about tuition and qualified expenses.

Submission Address for IRS 1098-E

To submit your IRS 1098-E, refer to instructions provided by the IRS based on your filing method. Typically, non-electronic submissions go to the IRS address specified in the procedural guidelines on their official website.

Having a thorough understanding of the IRS 1098-E can significantly benefit taxpayers seeking to take advantage of deductions related to student loan interest payments. For assistance in filing or utilizing tax forms effectively, consider reaching out to a tax professional or utilize streamlined online services. Empower yourself to optimize your tax submissions and maximize your financial benefits.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.