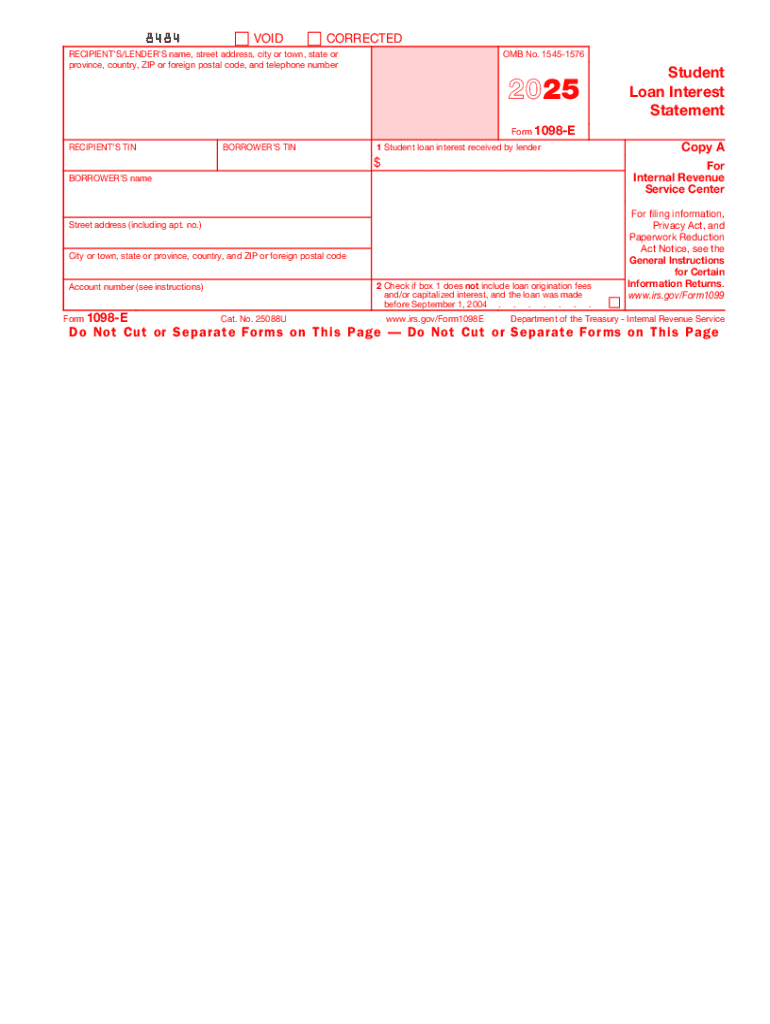

IRS 1098-E 2025-2026 free printable template

Instructions and Help about IRS 1098-E

How to edit IRS 1098-E

How to fill out IRS 1098-E

Latest updates to IRS 1098-E

All You Need to Know About IRS 1098-E

What is IRS 1098-E?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1098-E

What should I do if I need to amend an IRS 1098-E that I previously filed?

If you discover an error on your IRS 1098-E after filing, you should submit a corrected version of the form. Include a notation indicating it is a corrected form, and ensure you retain copies for your records. Always verify the amendments comply with the IRS guidelines to avoid future complications.

How can I check the status of my IRS 1098-E filing?

To verify the receipt and processing of your IRS 1098-E, you can use the IRS e-file tool or call their customer service. Be prepared to provide details such as your Social Security number and the amount reported to facilitate the status check.

Are e-signatures acceptable for filing the IRS 1098-E?

Yes, e-signatures are acceptable for submitting the IRS 1098-E, provided that the electronic filing meets IRS standards. Ensure that your e-signature process is compliant with relevant regulations to ensure the integrity of your submission.

What common errors should I avoid when filing the IRS 1098-E?

When filing the IRS 1098-E, common errors to avoid include incorrect payee information and misreporting the amounts. Double-check all entries and ensure consistency with your records before submission to minimize the risk of rejection or penalties.

What are the implications of receiving a notice regarding my IRS 1098-E?

If you receive a notice related to your IRS 1098-E, it is important to respond promptly. Review the notice details and prepare any necessary documentation to address the issue. Failure to respond appropriately could lead to additional inquiries or penalties.